|

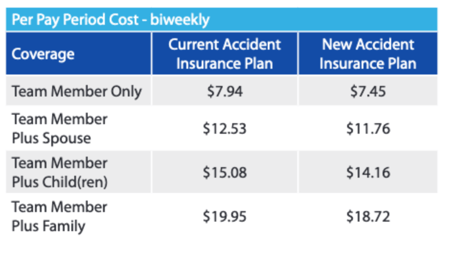

Accident Insurance - NEW Provider!

An unexpected accident can cause more than physical pain, it can hurt your bank account, too. Medical plans help cover the cost of care associated with an accident, but you’ll still likely face out-of-pocket expenses, like your deductible and coinsurance. And, unlike your medical plan, accident insurance through MetLife pays cash benefits directly to you, rather than to your provider. |

|

|

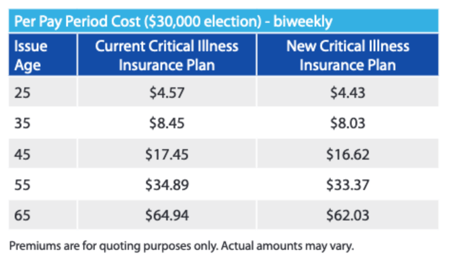

Critical Illness Insurance - NEW COVID-19 enhancement!

No one can be completely prepared when a critical Illness strikes, but if you or a loved one is diagnosed with a covered condition such as cancer, stroke, or heart attack, Critical Illness Insurance through MetLife provides a lump sum cash benefit to help pay for out-of-pocket medical expenses or any other bills that need attention, including rent, groceries, or child care. This plan also pays you $50 when you complete a covered health screening.The new Critical Illness plan through MetLife provides COVID-19 coverage at 25% of your elected benefit amount if you are diagnosed with COVID-19 and spend 5 consecutive days in the hospital as inpatient. |

|

|

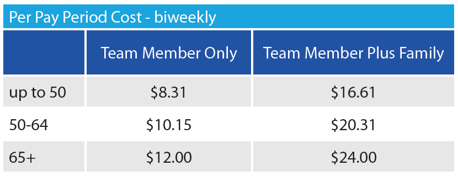

Cancer Guardian Even with health insurance, a stay in the hospital can become costly quickly as out-of-pocket charges begin to add up. Hospital Indemnity Insurance through MetLife can reduce the financial and emotional stress of a hospital stay by providing a lump sum cash benefit directly to you that can be used however you need, whether that’s for coinsurance or childcare.

|

|