2020 Benefits Open Enrollment

To ensure our employees understand the benefit options, we are working with EOI Service Company. Professional EOI benefit counselors will meet with you one-on-one by phone to help you enroll. Click here or the button below to schedule your enrollment appointment!

To help you better understand all your benefit offerings as well as assist you with completing your enrollment elections, we have partnered with EOI Service Company. You must speak with an EOI benefit counselor over-the-phone to review your benefit options and waive or enroll in benefits. Counselors will also educate you on the new bswift system, preventative care services, 2020 telehealth enhancements, and the new benefit programs available.

Bswfit, our new benefits enrollment system, makes enrolling easier than ever! Speak with a benefit counselor to learn more about the program.

We are now offering Accident, Critical Illness, Hospital Indemnity, and Short-Term Disability Insurance through Aflac. To facilitate a smooth transition and make sure that no one loses their coverage, all employees currently enrolled in a MetLife voluntary benefit will automatically transition to Aflac. Your current payroll deductions with MetLife will cease, and the new deductions with Aflac will begin with your first paycheck in July. If you are a new enrollee, you can enroll in these plans this year without answering any medical questions.

These new benefits also include COVID-19 testing and quarantine benefits. See below for additional information!

Effective July 1, 2020, Basic Term Life will be offered through Allstate. We believe you will be pleased with the new product and competitive rates. Speak with a benefit counselor to learn more!

If you currently have a Texas Life policy, you must take action to ensure you and your dependents have coverage under the new program. Effective July 1, your current Texas Life policy will no longer be available through payroll deduction and therefore can no longer be offered pre-taxed. If you would like to continue your coverage through Texas Life, you may do so on a direct bill basis. Benefit counselors can help you enroll in the new product through Aflac if you would prefer to switch carriers and continue with automatic payroll deductions.

See below for more information!

This new flexible life insurance program through Transamerica allows you to accelerate a portion of the death benefit if you are diagnosed as chronically or terminally ill to help pay for out-of-pocket medical expenses. See below for more information and how to enroll without answering medical questions!

Monarch Healthcare is committed to offering a portfolio of benefits that give you peace of mind in knowing that the most important things in life are protected - your family, your finances, and your future. For detailed information about each of the benefits plans and programs available to you and your family, please click on the down arrow for each benefit listed below.

Term Life Insurance through Allstate gives you peace of mind and an affordable way to take care of your family in the future. This coverage provides affordable term life insurance until age 100 and pays a lump-sum benefit in the event that death occurs prior to age 100. During this enrollment period only, you can elect coverage without answering any medical questions!

Short Term Disability Insurance through Alfac provides protection if an unexpected illness or injury keeps you from working. If you become disabled and can’t work, you may face a gap between your income and expenses. Short Term Disability Insurance can help fill this gap by paying you a weekly benefit until you are able to return to work. If you are unable to work due to a physician-directed quarantine, whether you meet you with a physician in-person or virtually using telemedicine, you will also be eligible for your weekly benefit following the plan’s elimination period. There are no exclusions for pre-existing conditions, and during this enrollment period only, you can enroll without answering medical questions!

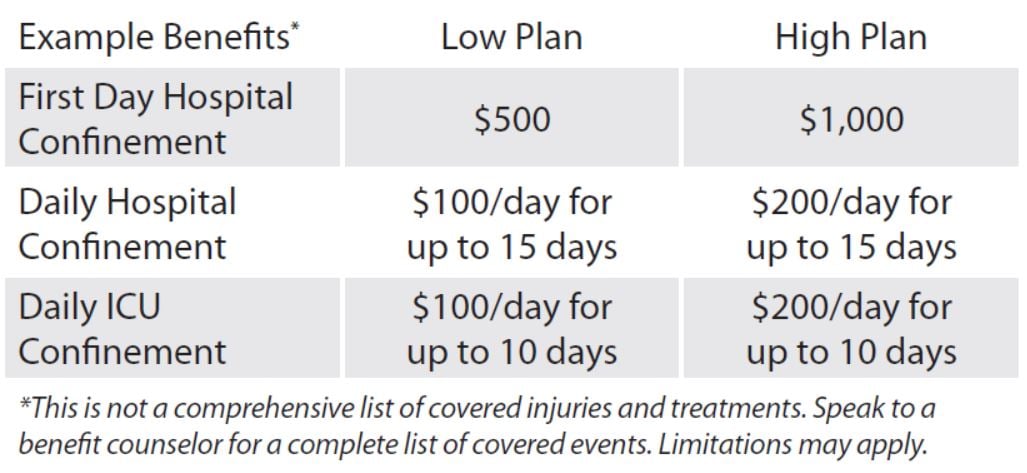

Even with health insurance, a stay in the hospital can become costly quickly as out-of-pocket charges begin to add up. Hospital Indemnity Insurance through Aflac can reduce the financial and emotional stress of a hospital stay by providing a lump sum cash benefit directly to you that can be used however you need. There are no exclusions for pre-existing conditions, and during this enrollment period only you can enroll without answering medical questions!

You have two plans to choose from!

Identity theft protection services from InfoArmor help assess your risk, deter theft attempts, detect fraud, and manage the restoration process in the event of identity theft. If InfoArmor detects suspicious activity, a certified privacy advocate can act as a dedicated case manager on your behalf and resolve the issue.

Universal Life Insurance through Transamerica offers flexible financial protection with a number of optional riders, including “living benefits” that allows the policyholder to accelerate a portion of the life insurance death benefit if diagnosed by a physician as chronically or terminally ill. These extra “living” benefits can be used to help pay expenses from an unexpected medical crisis and help alleviate the worry of future financial problems. During this enrollment period only, you can elect up to $150,000 of coverage for yourself without answering any medical questions!

Click here to learn more!

When you suffer an accident (on and off-the-job) such as a burn or broken bone, Accident Insurance through Aflac provides a lump-sum cash benefit based on your injury(s) and the treatment you receive. These benefits are paid on top of what your health insurance covers, and can be used at your own discretion. And every year that you complete a qualified health screening, you are eligible for a $50 Health Screening Benefit. Tests for COVID-19, as well as many other preventative tests, qualify for this health screening benefit. During this enrollment period only, you can enroll without answering medical questions!

You have two plans to choose from!

No one can be completely prepared when a critical illness strikes, but if you or a loved one is diagnosed with a covered condition such as cancer, stroke, or heart attack, Critical Illness Insurance through Aflac provides a lumpsum cash benefit to help pay for out-of-pocket medical expenses or any other bills that need attention, including rent or groceries. And every year that you complete a qualified health screening, you are eligible for a $50 Health Screening Benefit. Tests for COVID-19, as well as many other preventative tests, qualify for this health screening benefit. There are no exclusions for pre-existing conditions, and during this enrollment period only you can enroll without answering medical questions!

This annual enrollment period is the only opportunity to enroll in benefits until the next annual enrollment period unless you experience a qualifying life event and request a change to your benefits within 30 days of the life event.

To ensure our employees understand the benefit options, we are working with EOI Service Company, a professional enrollment firm with over 40 years in the benefits and communications industry. Professional EOI benefit counselors will meet one-on-one by phone to help you enroll.

During your one-on-one appointment, the benefit counselor will: